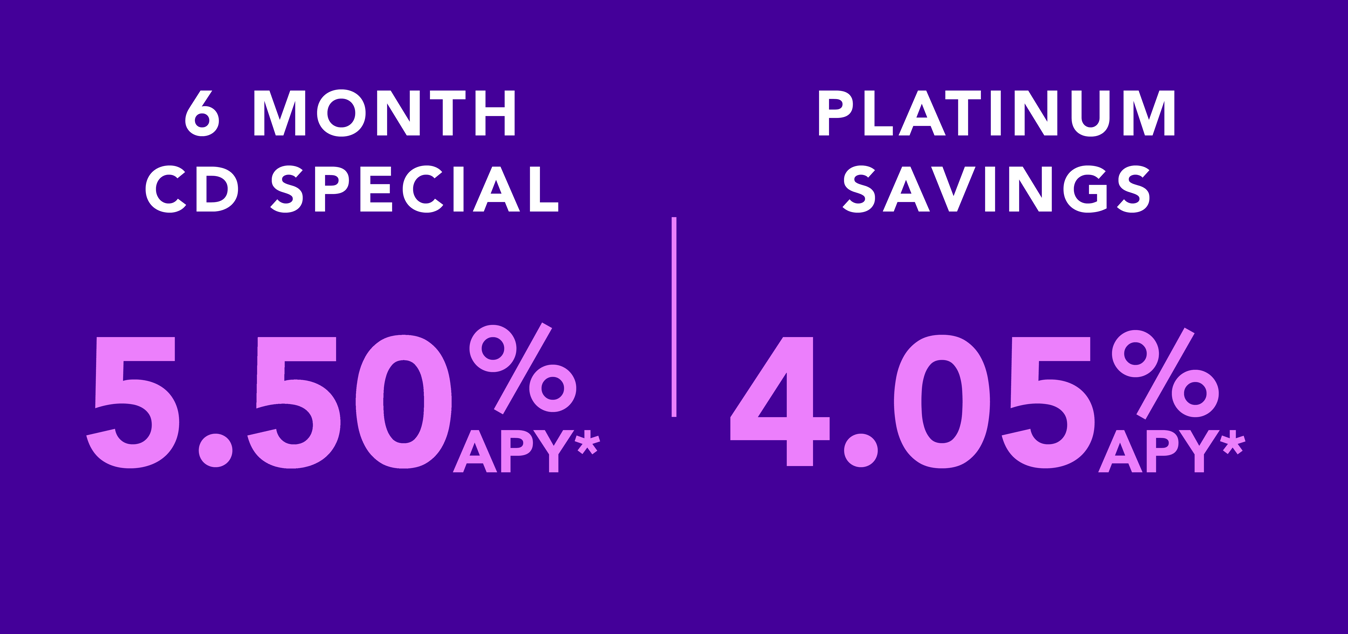

*The APY (Annual Percentage Yield) is accurate as of May 5, 2024, and is subject to change, without notice. Fees may reduce earnings. Please see fee schedule for more details. Minimum deposit to open is $500, no minimum balance required after initial opening deposit to obtain APY. Transactions may take one or more banking days from the date of transaction to post to and settle. Maximum of two (2) withdrawals per month. A $10 fee will be assessed per excessive withdrawal. Covered by FDIC insurance up to the maximum allowed by law.

The APY on the 6, 12 and 24-month CD Specials is fixed for the initial term of the CD. At maturity, CD Specials will auto-renew into the same term and product, at market rates.

All CDs receive FDIC insurance up to the maximum allowed by law.