3 Ways to Save Money Right Now

Are you looking for ways to save money fast? We’ve got some practical tips so that you can save money right now.

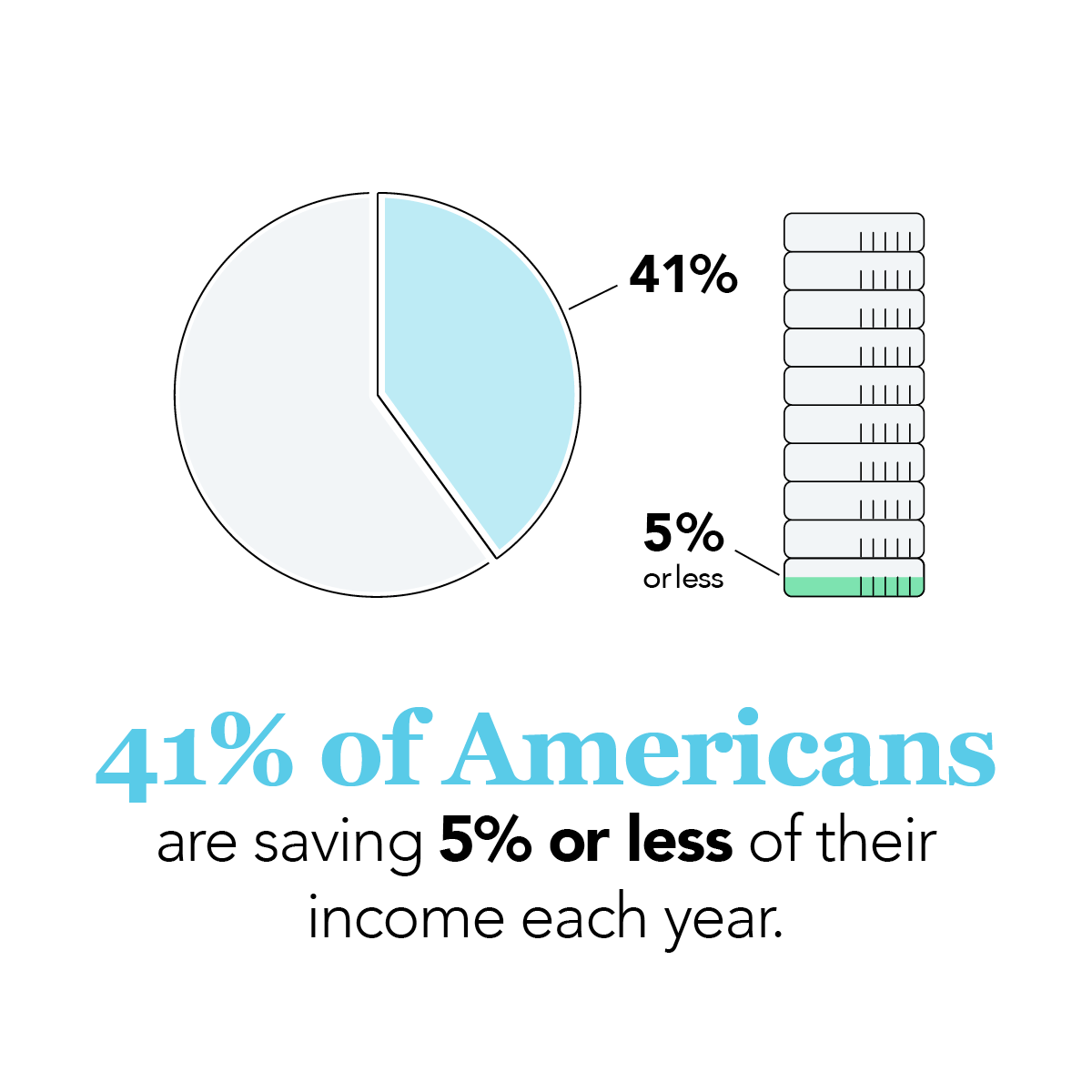

Getting motivated to save is easy, saving consistently is hard. If you have trouble saving, you are not alone. In fact, 41% of Americans are saving 5% or less of their income each year.

Once you become financially independent you know firsthand how quickly life can get expensive. It may start with student loans, then paying rent, maybe buying a home and having a mortgage, keeping your car maintained, paying for the necessities of life like groceries, internet, and electricity—the list goes on and the prices go up.

Among all of these required expenses is the expectation that you will somehow maintain a budget and develop some healthy saving habits. For most people, it’s easier said than done. In this guide, learn how to make the most of your money and get some simple ideas of how to start saving it along the way.

1) Budget

First things first—create a budget. And stick to it.

Try the 50-30-20 rule: allot 50% of your income to necessities, 30% to personal spending, and 20% to savings and/or debt repayment. If your percentages are out of balance, see where you may be able to make some adjustments and be disciplined about sticking to your budget.

Related: 4 Easy Ways to Create an Effective Budget

2) Beware of Spending Traps

Something else to think about as you budget and look to start saving money—beware of spending traps. These can be sneaky. Spending traps take on many forms, and they can take a toll on your monthly budget. Here are a few to look out for:

- Monthly subscriptions. Magazines or online streaming subscriptions, for instance. When’s the last time you logged on to the online newspaper subscription you have forgotten you had? How many streaming services do you really use? Take inventory of your subscriptions and see where you can cut back.

- Online shopping. Whether it is a sale on clothes or the latest outdoor gear, the temptation to compulsively click and purchase seems to get everyone one way or another. Try limiting your easy access to online shopping by staying logged out of frequently used sites. Sometimes the act of having to login will give you enough time to contemplate whether or not you truly need to make the purchase you are considering. Another idea to avoid this temptation is to unsubscribe from retailers’ emails that are constantly trying to get you to buy more.

- Ordering out. This is one of the most well-known money wasters. Is it bad to go out to dinner or buy a coffee? Hardly. But how much are you doing it? Cutting back even a little bit can make a huge impact on your budget. Try dedicated one day a week or a few times a month where you plan to order out. This will help you plan for the expense and even look forward to that special meal.

When it comes to spending traps, many times, it’s the small recurring “treat yourself” mindset purchases that really add up. If you have to, take out your spending money in cash each paycheck. This may help you to ration out how much you are truly spending. There are also plenty of apps that can help you with this, which we will be talking about soon in a future article.

Related: The Best Budgeting Apps to Try

3) Saving Strategies

Okay, we’ve talked about some small ways that you can cut back on your spending, but those strategies merely save you money in your monthly budget. When it comes to the actual task of saving money, you need a plan. Here are some saving strategies that you can start using today.

- Automatic transfer. Perhaps the easiest way to truly save money is by setting up an automatic transfer. When you get paid, have a certain amount automatically transferred to a separate savings account. This follows the concept of out of sight out of mind. Money that never makes it to your checking account is money that you won’t be thinking about in the first place. Open a savings account with a good interest rate to help you maximize the balance within your savings account—and watch it grow!

- Say no [for now] to impulse purchases. Delay impulse purchases. A good rule of thumb is to wait at least 24 hours when you’re tempted to make an impulse purchase. Time is generally the truest test of whether or not you really need (or even want) the item in question.

- Reduce interest rates. Do you have high interest debts? See if you can transfer your credit card balances to 0% APR cards. If you have a debt repayment plan, this could save you a significant amount of money in the long run that you would otherwise have been putting toward interest. If the 0% APR balance transfer is not an option for you, call your credit card providers and see if you can get a reduced interest rate. Every little bit helps.

- Recalculate student loan payments. Student loan payments can generally be recalculated based on your income level. Getting on an income-based repayment plan can enable you to save money from month to month. Refinancing a car or a mortgage can also be a good idea if you can get a significantly better interest rate.

- Plan out your grocery shopping. Nothing wastes money like a trip to the grocery store with no meal plans or list of ingredients you will need. Look at what you already have in your cupboard at home and plan your meals around using those items and having to purchase as few new things as possible.Take a little time to plan out your meals so you can go to the grocery store armed with a list of the items you need.

- Plan for large purchases: Do you have a large purchase coming up? Budget for it in advance. If you know you will need to buy a new appliance by the end of the year, start saving for it now. Try to shop for it on a holiday weekend when you know there will be significant discounts. It’s always beneficial to plan ahead.

Related: 3 Ways to Change Your Money Mindset

"Grow your savings with automatic transfers. "

Does the concept of saving money regularly feel useless? Look at contributing to your savings account like it is a bill, rather than an option: if your goal is to save $100 a month, then think of your savings goal as a $100 bill that needs to be paid. Start small. It’s all too easy to make lofty savings goals that are unrealistic. Instead of saying, “I’m going to save $10,000,” start with something small and realistic for you and your budget. Even saving $100 per month is going to make a positive impact on your financial future. Start small if you need to, but most importantly, start saving.

References

- Berger, Roger. Money Saving Tips - 92 Painless Ways to Save Money. (2018, August 16). Retrieved from https://www.doughroller.net/smart-spending/51-painless-money-saving-tips/ (accessed 2019, September 2).

- Elkins, Kathleen. Here’s how many working Americans aren’t saving any money for retirement or emergencies at all. (2019, March 14). Retrieved from https://www.cnbc.com/2019/03/14/heres-how-many-americans-are-not-saving-any-money-for-emergencies-or-retirement-at-all.html (accessed 2019, October 2).

- Nerd Wallet. How to Save Money. (2019). Retrieved from https://www.nerdwallet.com/blog/how-to-save-money/?trk=nw_gn1_4.0 (accessed 2019, September 2).

- Vohwinkle, Jeremy. (2018, December 7). 3 Effective Ways to Save Money on a Tight Budget. Retrieved fromhttps://www.thebalance.com/the-secret-to-saving-money-1289722 (accessed 2019, September 2).