The 5 Best Budget Calculators and Worksheets to Organize Your Finances

Whether your budget is large or small, it’s important to maximize it in the best way possible, ensuring all of your bills are paid and expenses don’t exceed your income. Budgeting is a necessary task for anyone who wants to be wise and informed about their finances.

There are a lot of free budgeting worksheets you can find online, and they tend to have their own particular approach to managing money. Here are some budgeting worksheets you may want to try for your budget next month--or try them all and see which one you like the best!

Related: 4 Easy Ways to Create an Effective Budget

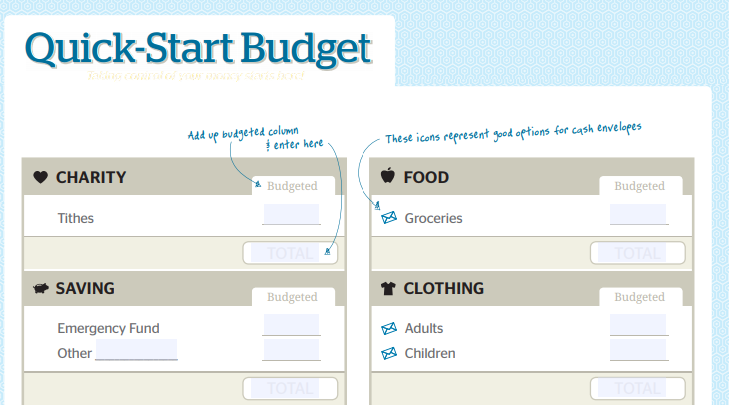

1. Quick Start Budget

If you’ve never budgeted before, this budget worksheet is a great starting point. It has separate columns for all of your basic expenses and the sole purpose is for you to track the total amount of expenses you have each month. Something that is handy about this one is that there are little envelope icons next to certain categories, which indicate areas of your finances that it may be helpful for you to use the envelope system to stay on track. Learn more about the Quick Start Budget.

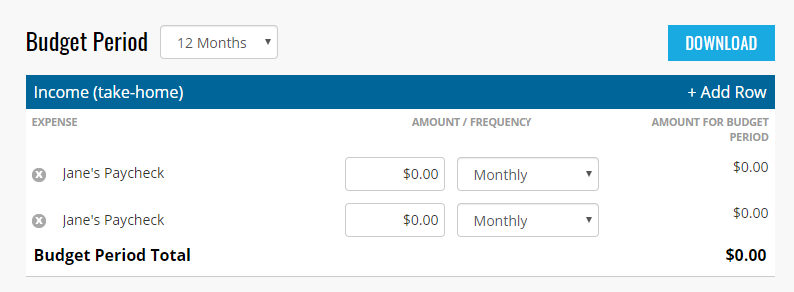

2. Household Budget Worksheet

Okay, maybe you’re not starting from square one with your budgeting habit. This household budget worksheet may be just what you need. It not only tracks your monthly expenses; it tracks your income and has a miscellaneous category, as well, where you can budget for things like vacations or clothing purchases.

There are “x” boxes next to each row as well as the ability to add rows, so your budget items are customized. Once you’ve completed your budget worksheet, you can download it for easy access. Learn more about Household Budget.

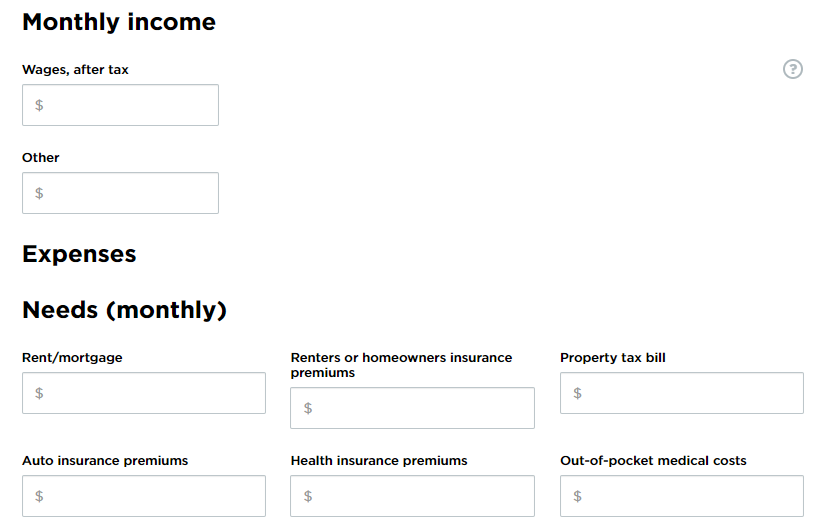

3. 50/30/20 Monthly Budget Worksheet

According to NerdWallet, 50 percent of your budget should go to needs, 30 percent to wants, and 20 percent to savings and debt repayment. This form will auto-calculate how your budget conforms to these percentages. It’s convenient because it gets more specific in the different spending categories, which can help differentiate between what would qualify as a want versus a need. For example, internet access is listed as a need while a cable TV package is categorized as a want. This worksheet is also downloadable. Learn more about the 50/30/20 Monthly Budget Worksheet.

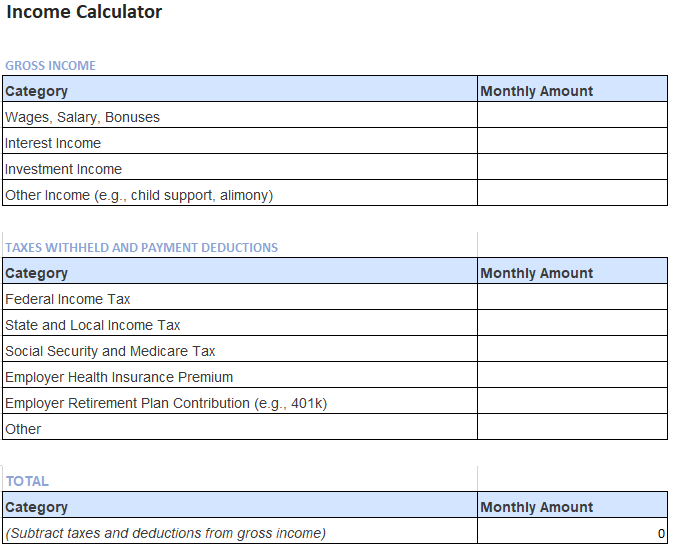

4. Pre-Created Basic Excel Worksheets

Whether an Excel novice or expert, these downloadable pre-made budgeting worksheets can be very useful, especially because they have already been formatted to calculate totals for you. This tool is definitely for people who love number and prefer budgeting in Excel.

One calculates income, including pre- and post-taxes, which can be beneficial for you to see how much you are really making and what percentage of it is going to taxes or other pre-tax deductions. Another worksheet calculates your expenses, and the last one calculates your budget surplus or shortage for each month. Learn more about Basic Budget Excel Worksheets.

5. Monthly Cash Flow Budget

This is a more detailed budget plan that includes a few really nice features. There are recommended percentages of your budget that should be allotted to each spending category. It drills down a bit more in depth than the 50/30/20 budget.

Something else that is really convenient is that there is a “Spent” column and a “Budgeted” column for each line item. So, each month, you can look at what you budgeted for groceries, for instance, and then compare your budgeted number with the amount you actually spent. Tracking your budget in this way will help you to create more accurate monthly budgets moving forward and will also help you to establish the priorities you want. Learn more about the Monthly Cash Flow Budget.

Just as with creating a budget in the first place, there is no one-size-fits-all when it comes to budgeting worksheets. Choose the one that makes the most sense to you--and you will be more likely to stick with it. Any budgeting worksheet you use will serve as a visual guide to keep you aware of and on track with your finances each month.

References

- Household Budget Worksheet. (2017). Retrieved from https://www.kiplinger.com/tool/spending/T007-S001-budgeting-worksheet-a-household-budget-for-today-a/ (accessed 2019, October 13).

- Schwahn, Lauren. Free Budget Worksheet. (2019, January 14). Retrieved from https://www.nerdwallet.com/blog/finance/budget-worksheet/ (accessed 2019, October 13).

- Useful Forms. (2019). Retrieved from https://www.daveramsey.com/askdave/other/useful-forms (accessed 2019, October 13).

- Vohwinkle, Jeremy. (2019, October 3). Retrieved from https://www.thebalance.com/basic-monthly-budget-worksheet-1289585 (accessed 2019, October 13).